When is BAS Due in 2023-2024?

One of the most common questions I hear from business owners – and one of the most common questions any business accountants receive – is simply: when is BAS due? So, I am here to walk you through everything you need to know about BAS, including how to pay BAS, lodging BAS, BAS due dates, avoiding late payments, what to do if you make mistakes, and more.

Key Takeaways

- Quarterly BAS Due Dates: 28th day after each quarter, with an exception for Q2 (28 February 2024).

- Monthly BAS Due Dates: 21st of the following month.

- Annual BAS Due Dates: Either 31 October or 28 February.

- Lodging Methods: Options include agents, online via ATO/MyGov, or mail.

- Payment Methods: Use credit card, BPAY, or debit.

- Extensions: Online lodgings may get a two-week extension.

- Penalties: Late lodgings can incur penalties.

- Mistakes: Address by the next due date or seek help.

- BAS vs GST: BAS reports various taxes including GST; GST is a specific tax.

- Sole Traders: Must pay BAS if income exceeds $75,000.

- Reducing Payments: Claim all GST credits and consider cash basis for GST.

- Unable to Pay: Lodge BAS anyway to avoid additional penalties.

- Organisation Tips: Keep detailed records and use correct PRN for payments.

- Professional Help: Consider hiring an accountant for accuracy and timeliness.

When Is BAS due?

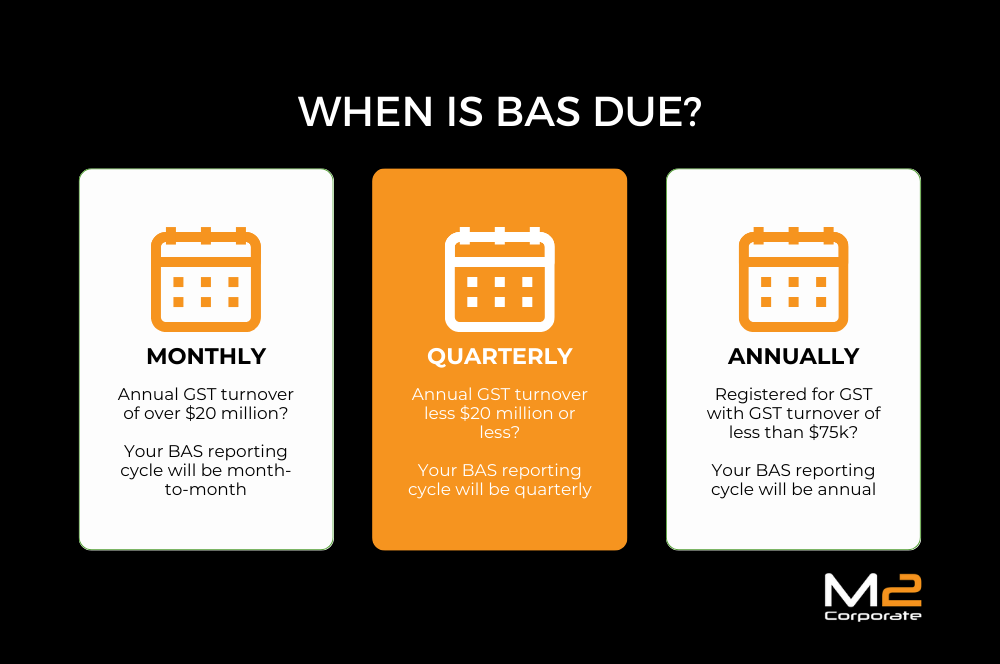

BAS payment due dates are based on the annual GST turnover of your business. For instance, smaller businesses will have less activity to report.

Payment due dates for small businesses are usually annually or quarterly based on the following criteria:

- If your business has an annual turnover of $20 million or less, you will have a quarterly BAS reporting cycle (unless the Australian Taxation Office notifies you otherwise)

- If your business has an annual turnover of over $20 million your BAS reporting cycle will be monthly

- If register your business voluntarily for GST and have a turnover of less than $75,000 you will be responsible for reporting BAS annually (note: non-profit organisations have a limit of $150,000)

How to Lodge a BAS

There are several ways BAS statements can be lodged, including:

- Through a registered tax or BAS agent

- Online via the ATO

- Online through MyGov portal if you are a sole trader

- By mail

It is crucial to know relevant BAS due dates and lodge your BAS on time to avoid penalties.

BAS can be paid by credit card, BPAY, or debit.

Note: If you are lodging online, you may qualify for an extra two weeks to lodge your BAS. Check with the ATO regarding possible BAS lodging extensions.

What Are the BAS Due Dates 2023 / 2024?

Wondering when BAS is due? Here are the BAS Due Dates 2023 / 2024 broken down into quarterly, monthly, and annual dates.

What Are the Quarterly BAS Due Dates 2023/2024?

Small businesses with GST turnover of less than $20 million need to lodge BAS by the 28th day of the month that follows the end of their financial quarter.

Note: The second quarter’s end in December is pushed from a reporting deadline of January to February.

Here are the quarterly BAS due dates 2023 / 2024:

- Quarter 1: July to September 2023 quarter is due 28 October 2023

- Quarter 2: October to December 2023 quarter is due 28 February 2024

- Quarter 3: January to March 2024 quarter is due 28 April 2024

- Quarter 4: April to June 2024 quarter is due 28 July 2024

What Are the Monthly BAS Due Dates 2023 / 2024?

For larger businesses in Australia, they are required to lodge a monthly business activity statement.

Since larger businesses typically have more to report, lodging a monthly BAS helps monitor cash flow and eliminate a huge tax bill every quarter.

For Australian businesses with an annual GST turnover of more than $20 million, the BAS due date falls on the 21st of the next month.

For instance, your business’s May BAS report will be due on the 21st of June.

Here are the monthly BAS due dates 2023 / 2024:

- BAS due date July 2023: 21 August

- BAS due date August 2023: 21 September

- BAS due date September 2023: 21 October

- BAS due date October 2023: 21 November

- BAS due date November 2023: 21 December

- BAS due date December 2023: 21 January

- BAS due date January 2024: 21 February

- BAS due date February 2024: 21 March

- BAS due date March 2024: 21 April

- BAS due date April 2024: 21 May

- BAS due date May 2024: 21 June

- BAS due date June 2024: 21 July

Annual BAS Due Dates

If your business needs to lodge annual BAS, the due date for annual GST is 31 October.

If your business isn’t required to lodge a tax return, your annual BAS due date will be 28 February after the annual tax period.

FAQs

What is a BAS?

BAS refers to a Business Activity Statement. If your business is registered for Goods and Service Tax (GST), you must submit a BAS form to the Australian Taxation Office (ATO).

Lodging a BAS with the Australian Taxation Office lets them know how much tax you owe or how much tax you need to be refunded for.

A BAS reports on the following aspects of your business:

- PAYG withholding tax

- PAYG installments (pay as you go)

- GST (Goods and service tax)

- Other applicable taxes your business is required to pay

What is a BAS agent?

A BAS agent is a professional specialising in advising and representing businesses in GST, payroll, and other tax-related matters.

For more information, read our blog covering what is a BAS agent and their required qualifications.

What happens if BAS is late?

It is imperative to lodge your BAS accurately and on time. If your BAS is late, you may be penalised by the ATO. Always lodge your BAS when it is due.

Are BAS and GST the same?

No. BAS and GST are not the same. A BAS is a business activity statement. GST refers to the goods and service tax that gets applied to the majority of Australian goods. GST must be reported on your BAS.

Do sole traders have to pay BAS?

Yes, sole traders must pay BAS if their gross income is over $75,000.

What happens if the BAS is due on a weekend?

BAS due dates that fall on weekends or public holidays do not have to be lodged and paid until the next business day.

What happens if I make a mistake on my BAS?

If you enter an incorrect amount or accidentally exclude GST from a sale, you’ll need to address these mistakes. This can be done by contacting a tax professional and fixing the mistake by the next due date cycle. Working with a qualified business account can help prevent these BAS mistakes.

Who can lodge BAS?

You can lodge your BAS returns or hire a registered tax professional to lodge your BAS for you. Hiring a business accountant to lodge your BAS ensures compliance, prevents your BAS from getting lodged late, and takes the hassle out of the process.

Are there ways to reduce BAS payments?

If you are making these common BAS mistakes, your business may be paying too much.

Here are some tips on how to reduce BAS payments:

- Make sure you claim all your GST credits to reduce the amount of GST your business is responsible for paying on the sale of goods and services

- If your small business has a turnover of $10 million or less, consider paying GST on a cash basis. Paying GST on a cash basis means you pay GST in the BAS period where your business is actively receiving payment from customers. Paying GST on a non-cash basis means you are paying in a BAS period when your business is invoicing customers rather than actually getting payments.

- Make sure you aren’t accidentally including GST on sales that are GST-exempt (GST-exempt sales often involve medical or health services, food, etc.)

A tax professional can help ensure your business is not making these common BAS mistakes and paying more than necessary.

What happens if I am not able to pay?

Even if you are not able to pay, it is still recommended to lodge your BAS. This proves to the Australian Taxation Office that your business is aware of its tax obligations and working toward compliance.

What are the best BAS tips?

Keep your BAS organised with these tips:

- Maintain detailed records of all business expenses, wages, invoices, vehicle log books, stock takes, etc.

- Make sure all sales invoices include GST

- Make sure all lodgements are up to date with accurate banking details to avoid delaying your BAS refund

- Use accounting software to maintain accurate records and calculate GST

- When making your BAS payments to the Australian Taxation Office, use the correct PRN (payment reference number)

- Consider working with a business accountant to ensure your BAS is accurate and lodged on time

Do You Have More Questions on How to Pay BAS?

If you’re looking for more help on how to pay BAS, enquire today with my award-winning team of accountants.

With decades of combined experience, my team of experts will make sure your BAS gets lodged accurately, on time, and without the hassle. Get in touch today.